When we last examined the “Commvergence” imperative for communications service providers (CSPs), we dove into the product and service mixes deployed by some of the industry’s most successful players. There are great opportunities to build deep product portfolios for end customers, but the sheer numbers of options can make go-to-market plans very complex.

If you think about product and service offerings (and the team members that deliver them) as a CSP’s “front of the house,” the operations to realize revenue and ensure efficiency can be considered the “back office.” While there is a natural temptation for CSP executives to focus the vast majority of attention on the front of house (e.g. product offerings, company branding, messaging, sales strategies, pricing, etc.), you shouldn’t forget about the importance of a high-quality back office to realization of revenue, efficiency management, and building a foundation to scale your business in the long run.

At Rev.io, we advocate for CSPs utilizing purpose-built solutions for back office functions. Of course, we also acknowledge that getting to the point of a true best-in-breed mix can be a long process.

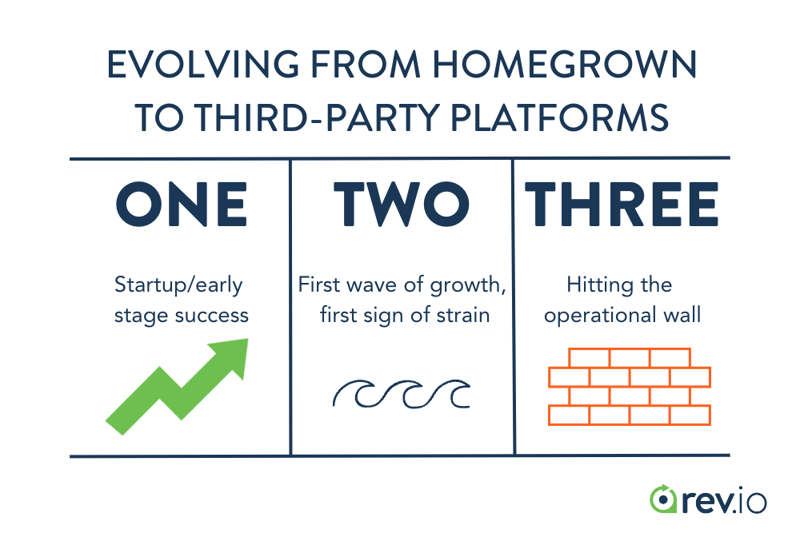

Evolving from homegrown to third-party platforms

In our experience in speaking to hundreds of service providers over the years, we often find that their back office evolution follows this pattern:

- Startup/early stage success: with capital often tight and teams small, CSP leaders utilize as many free/low-cost tools as possible, while also relying on rock star operational employees to build and execute repeatable processes.

- First wave of growth, first sign of strain: As revenue and customer counts grow, the company expands some operations but is hesitant to make major system purchases. Their homegrown systems and processes still work, but begin to strain under the weight of a larger business footprint.

- Hitting the operational wall: At some point in a successful CSP’s lifecycle, they will reach a point where their old way of managing their back office doesn’t work at scale. Speaking to our area of billing expertise, some examples we have seen include inaccurate usage rating among a large customer base (leading to revenue leakage), challenges in tax rate calculations among a geographically dispersed footprint, or long hours spent to prepare invoices, send bills, and ensure cash collections.

The good news for CSPs is that there are thousands of solutions out there to cover virtually all of their particular back office and operational needs. The bad news is that not all of these solutions could be called “best of breed,” and furthermore they often lack the interoperability that is vital to minimize data reentry and avoid manual errors.

Because no single business operations software operates in a vacuum, we advise our clients to think about interoperability and integrations as critical factors in selecting which software packages to go with for their billing and beyond.

Table Stakes for a High Functioning Back Office:

Here are a few areas where best-in-breed solutions are critical for CSPs:

Customer Relationship Management: Long gone are the days of the rolodex, as organizations both large and small have adopted professional CRM software to manage their target accounts and contacts throughout a sales process. As the pure data management functionality has become table stakes, many companies behind CRM platforms have expanded their functionality in areas like reporting and analytics. Salesforce generally remains top dog among CSPs, but platforms like HubSpot, Zoho, and PipeDrive have carved out a share of this market as well.

Here’s an important wrinkle in the CRM discussion: what are you using for customer data management when you transition from pre-sale to post-sale? As your sales team builds client relationships and knowledge through the sales process, they will input contact and intelligence data to a platform like Salesforce. But what happens after the deal is closed? All that data will have to move into a post-sales platform.

Some of the CRMs in the market include features on both sides of the signature, but from our perspective, it is critical that the post-sales portion can seamlessly integrate with your billing functionality to maximize accuracy within your quote-to-cash process.

Payment Portals: At the end of the day, all the great work by a CSP should end with money in the bank. But many times, the choice of a payment portal for credit card or ACH transactions is not a priority for executives. This can prove to be a mistake as you structure your CSP back office.

There are many options for CSPs to use for payment processing, with well known names including Authorize.net, Stripe, Square, or PayPal. While it’s tempting to think of these portals as commodities, there can be meaningful differences in the way transaction fees are structured, along with operational considerations like settlement time.

Our advice to CSPs is to look for a billing system that integrates payment processing seamlessly while minimizing hidden charges.

Accounting Systems: Once the bills are out, the payments are collected, and the cash is in the bank, it’s time to settle your books. Third-party accounting platforms have some of the longest legacies in the business operations software space, with names like QuickBooks and Sage now in their fifth decade in the marketplace. The staying power of these platforms speaks to the quality of their products and their adaptability to changing customer demands over time.

That said, accounting software is a tricky area for CSPs when they ask their systems to do too much. These systems lack some of the enhanced functionality of purpose-built billing systems to create and distribute invoices efficiently, while also lacking some needed collections functionality.

More concerningly for CSPs, billing for some telecom services is restricted by QuickBooks Online’s terms of service. While the complexities of the telecom market do leave some of these rules up to interpretation, we think it’s another good reason to look at purpose-built systems for billing.

Tax Databases: Taxes are one of life’s two inevitabilities, and unfortunately in the life of the CSP they are also massively complex. In the United States, a cross-section of geographic units (federal, state, county, and municipal) keep a long list of specific tax rates for hundreds of telecom products. It’s estimated that there are over 10,000 taxable jurisdictions in the US, and the specific rates per product are not static.

Simply put, this is not an area to mess around with as a CSP. An automated tax database can give you the peace of mind to ensure proper calculations and not miss when changes happen. Excellent, well-established companies like Wolters Kluwer (creator of CCH SureTax), Avalara, and Compliance Solutions provide well-maintained tax databases, all of which integrate with Rev.io’s billing functionality.

Whatever it is, it has to connect

While the types of back office systems that we highlighted in this article are very common across the CSP universe, the list only scratches the surface of what your business uses (or should use). The final point to make is that no matter what set of systems you use, you need to consider the integration capabilities between them. In our experience, a strong REST API should be in place within your system in order to maximize the ability to integrate data between disparate systems.

In particular, we believe in an open REST API and giving developers access to information to be able to build integrations in a way that makes sense to each CSP’s goals and unique business rules. Between an open API as well as existing integrations with key systems like the ones above, Rev.io has set us within an ecosystem of best-of-breed platforms, working together for maximum client success and efficiency.

Interested in learning more about our integrations? Let us know!